Lower loan quantities. Lenders limit loan amounts for undesirable credit business loans to lessen the potential risk of lending to higher-risk borrowers. Based on components like your business revenue and time in business, you might be restricted to business loans for $100,000 or much less.

You can apply for secured business loans via traditional banking institutions, credit unions or online lenders. Watch out for hidden fees, which can enhance the Over-all Value of the loan.

Once you get acceptance, your lender will deliver you a business loan arrangement. You’ll need to critique the settlement totally and you should definitely recognize all the terms and conditions.

Although conventional banking institutions could just take days or even weeks to fund, lots of online lenders can provide entry to resources as promptly as inside a business day. Lines of credit could incur much more service fees than a business loan, which could increase as much as a better borrowing Charge. You’ll want to help keep this in mind When it comes to the entire price of a business line of credit. Common costs for business lines of credit involve an annual cost, an origination fee when you very first utilize, a maintenance or month-to-month price to the account and draw fees each time you pull within the line of how to get approved for a business line of credit credit. Secured vs. unsecured line of credit

These lenders typically have a “massive-picture technique” by thinking about your business’s prospective for progress rather than necessitating robust credit scores. That said, you sometimes have to have to function for at least 6 months to qualify for startup financing.

Bank of The us’s secured time period loan offers competitive desire prices and long repayment terms. It will give you the choice to secure your loan utilizing business belongings or certificates of deposit.

Pupil loans guidePaying for collegeFAFSA and federal scholar aidPaying for profession trainingPaying for graduate schoolBest personal university student loansRepaying pupil debtRefinancing university student financial debt

Pros In-man or woman customer care and expert insights Features discount rates for veterans Cost-free rewards system for business users Negatives Doesn’t disclose most price ranges Not perfect for startups Might have to apply about the mobile phone or in human being Why we picked it

Premiums and conditions: We prioritize lenders with aggressive charges, limited expenses, adaptable repayment phrases, A selection of loan quantities and APR bargains.

Validate Lender Credentials: Test the credentials and background of opportunity lenders. Validate their registration, licensing, and regulatory compliance. This could assist stay clear of scams and make sure you’re handling a legit lender.

Could be decreased than unsecured business loans, based on the lender along with your Total qualifications.

When analyzing offers, be sure to evaluate the economic institution’s Conditions and terms. Pre-competent provides are certainly not binding. If you find discrepancies using your credit score or details out of your credit report, be sure to Call TransUnion® specifically.

Bank of The united states delivers secured business loans with competitive charges and terms. You are able to secure your loan with business belongings or certificates of deposit.

Unsecured lines of credit, on the other hand, can continue to be an excellent option for people who will need rapid access to capital—and also For brand spanking new companies that don’t have adequate collateral to provide.

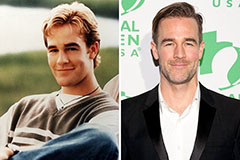

James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!